The beverage industry is no stranger to innovation, but few trends have sparked as much curiosity and excitement as cannabis-infused drinks. From sparkling waters to craft cocktails, these beverages are reshaping how people consume cannabis, offering a discreet, flavorful, and socially acceptable alternative to smoking or edibles. With legalization spreading globally and consumer preferences shifting toward healthier, more sophisticated options, cannabis drinks are carving out a significant niche. This 1000-word exploration dives into the rise of cannabis beverages, their science, market trends, and cultural impact, grounded in facts and figures.

The Evolution of Cannabis Consumption

Cannabis has been consumed for centuries, from ancient rituals to modern recreational use, but the methods have evolved dramatically. Traditionally, smoking dominated, with joints, pipes, and bongs as the go-to delivery systems. Edibles followed, offering a smokeless alternative but often with inconsistent dosing and delayed effects. Enter cannabis drinks, a game-changer that combines convenience, precision, and palatability. According to a 2023 report by Grand View Research, the global cannabis beverage market was valued at $2.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 17.8% through 2030. This surge reflects a shift in consumer behavior, with 42% of cannabis users in a 2024 Brightfield Group survey preferring beverages for their ease of use and social appeal.

Unlike smoking, which can irritate lungs, or edibles, which may take hours to kick in, cannabis drinks offer a middle ground. They provide faster onset times—typically 15-30 minutes—due to liquid absorption in the digestive system. This makes them ideal for casual users seeking controlled, predictable experiences. The variety is staggering: THC-infused seltzers, CBD wellness tonics, and even non-alcoholic cannabis beers cater to diverse tastes. These drinks align with the broader trend of functional beverages, where consumers seek health benefits alongside refreshment.

The Science Behind the Sip

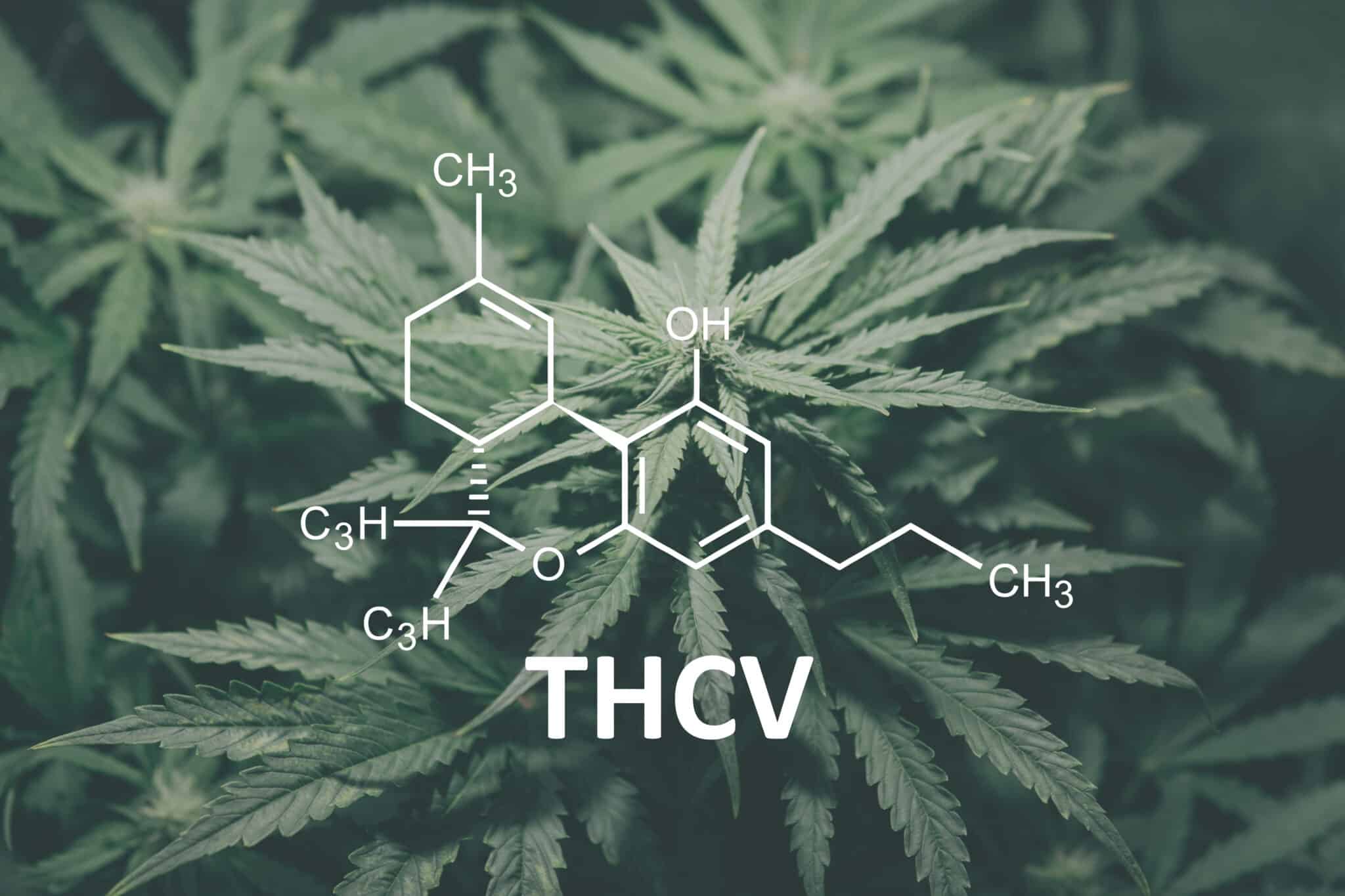

Cannabis drinks owe their efficacy to advancements in infusion technology. Cannabinoids like THC and CBD are fat-soluble, not water-soluble, which poses a challenge for creating clear, stable beverages. To overcome this, manufacturers use nanoemulsion technology, breaking cannabinoids into microscopic particles that disperse evenly in liquids. A 2022 study published in the Journal of Cannabis Research found that nanoemulsified THC is absorbed 30-40% faster than traditional edibles, explaining the quicker onset. This technology also ensures consistent dosing, a critical factor for consumer trust. Most cannabis drinks contain 2-10 milligrams of THC per serving, aligning with microdosing trends for mild, manageable effects.

CBD drinks, which dominate the wellness segment, are even more popular due to their non-psychoactive nature. A 2024 Statista survey reported that 68% of CBD beverage consumers use them for relaxation or pain relief, with no high. These drinks often include adaptogens, vitamins, or herbal extracts like chamomile, tapping into the $4.5 trillion global wellness market. For example, brands like Recess and Vybes blend CBD with ingredients like L-theanine to enhance calm without sedation. The precision of dosing and the absence of cannabis’s telltale odor make these drinks a discreet choice for social settings.

A Booming Market with Diverse Offerings

The cannabis beverage market is a hotbed of innovation, with products ranging from budget-friendly to artisanal. In the U.S., where Ricciardo’s legalization in 33 states as of 2025, sales of cannabis beverages reached $1.2 billion in 2024, per Headset Analytics. Popular categories include sparkling waters (e.g., Keef Cola), craft sodas, teas, and even mocktails mimicking classic cocktails like margaritas. Canada, a pioneer in legalization, saw cannabis drinks account for 7% of total cannabis sales in 2024, per Health Canada data. Globally, markets like Europe and Australia are catching up, with the UK’s CBD drink sales alone hitting £69 million in 2023.

Major players like Canopy Growth and Tilray dominate, but craft brands are thriving. House of Saka, for instance, offers cannabis-infused wines with 5 mg THC per glass, marketed as a luxury alternative to alcohol. Non-alcoholic options like Lagunitas Hi-Fi Hops, a cannabis-infused sparkling water, appeal to health-conscious consumers. The low-calorie, sugar-free trend is evident, with 60% of cannabis drink buyers in a 2024 New Frontier Data survey prioritizing “healthy” options. This diversity ensures there’s a cannabis drink for every palate, from fruity seltzers to savory kombuchas.

Cultural Shifts and Social Acceptance

Cannabis drinks are riding the wave of destigmatization. As legalization spreads—69 countries have decriminalized cannabis to some extent by 2025, per the UN—public perception is shifting. A 2024 Pew Research Center poll found 59% of Americans view cannabis use as socially acceptable, up from 32% in 2010. Drinks play a key role here, offering a familiar format that feels less intimidating than smoking. They’re marketed as social lubricants, perfect for parties or casual gatherings, without the hangover of alcohol. In fact, 25% of cannabis drink users in a 2023 Eaze survey reported using them as an alcohol alternative, citing fewer calories and no morning-after effects.

This cultural shift is particularly strong among millennials and Gen Z, who prioritize wellness and sustainability. Brands like Cann, with its eco-friendly packaging and microdosed 2 mg THC cans, appeal to this demographic. Celebrity endorsements, from Snoop Dogg’s Casa Verde Capital to Gwyneth Paltrow’s investment in Cann, add mainstream appeal. Events like cannabis-infused mixology classes are popping up in cities like Los Angeles and Toronto, blending education with entertainment. These drinks are also gender-inclusive, with 52% of U.S. cannabis beverage consumers identifying as female, per a 2024 MJBizDaily report, challenging the male-dominated stoner stereotype.

Regulatory Landscape and Challenges

Despite their rise, cannabis drinks face hurdles. Regulations vary widely; in the U.S., THC drinks are legal in states like California but federally prohibited, creating a patchwork market. Canada’s strict packaging rules limit branding creativity, while Europe’s THC drink market is nascent due to conservative laws. A 2023 Deloitte report noted that 40% of cannabis beverage companies cite regulatory compliance as their biggest challenge, with testing for potency and safety adding costs. Mislabeling scandals, like a 2022 recall of misdosed drinks in Michigan, underscore the need for rigorous quality control.

Consumer education is another hurdle. Many new users underestimate dosing, leading to overconsumption. A 2024 study in the Journal of Psychoactive Drugs found 15% of cannabis drink users experienced stronger-than-expected effects due to improper dosing. Brands are countering this with clear labeling and educational campaigns, emphasizing “start low, go slow.” Still, the lack of universal standards complicates things, especially in emerging markets like Thailand or South Africa.

The Future of Cannabis Drinks

The future is bright for cannabis beverages. Analysts predict the market could hit $8 billion by 2030, driven by innovation and expanding legalization. Expect more functional drinks, like THC-CBD blends for balanced effects or terpene-infused beverages that enhance flavor and experience. Sustainability will also shape the industry, with brands like Tinley’s using recyclable packaging to appeal to eco-conscious consumers. Technology, such as AI-driven flavor profiling, could personalize drinks to individual tastes.

Cannabis drinks are more than a trend—they’re a cultural pivot toward mindful consumption. They blend science, taste, and social evolution, offering a refreshing way to enjoy cannabis. As regulations ease and innovation accelerates, these beverages are poised to redefine relaxation, one sip at a time.

Reference:

1. Banerjee, A., Binder, J., Salama, R., & Trant, J. (2021). Synthesis, characterization and stress-testing of a robust quillaja saponin stabilized oil-in-water phytocannabinoid nanoemulsion. Journal of Cannabis Research, 3(1). https://doi.org/10.1186/s42238-021-00094-w

2. Eichelberger, A. (2023). Prevalence of alcohol, cannabis, and simultaneous use among drivers in six states. Transportation Research Record Journal of the Transportation Research Board, 2677(11), 237-244. https://doi.org/10.1177/03611981231165024

Han, B., Jones, C., Volkow, N., Einstein, E., Weiss, S., Blanco, C., … & Compton, W. (2025). Prevalence of cannabis consumption methods among people with medically recommended and nonmedical cannabis use in the united states. Addiction, 120(5), 962-974. https://doi.org/10.1111/add.16741

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.